The Volunteer Income Tax Assistance (VITA) program through AACC's School of Business and Law is a free, no-strings-attached federal and state income tax preparation, review and e-filing service for qualifying Maryland taxpayers making $64,000 or less in tax year 2023.

VITA 2024 will be offered in one format, by appointment only.

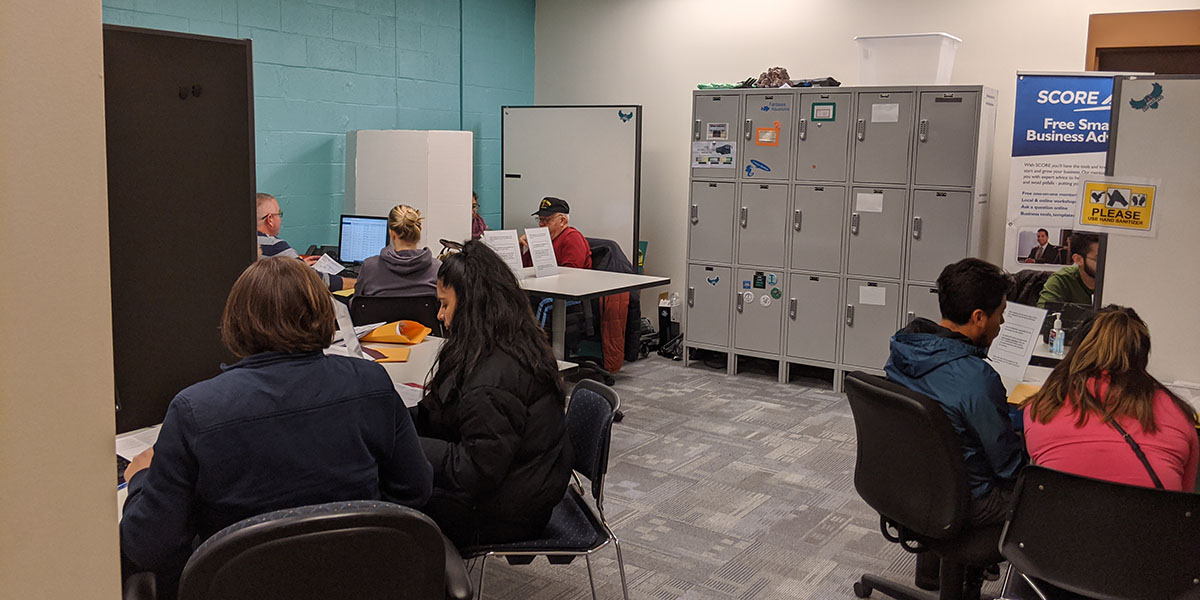

Your federal and state returns are prepared by IRS-certified AACC students, faculty, staff and alumni. These volunteers are supervised by AACC Business Administration/Accounting faculty members and AACC staff, many of whom are certified public accountants. During your appointment, we will meet with you, discuss your tax situation and prepare your federal and state returns. Returns will then be e-filed. If a refund is due, that money can be deposited directly into your bank account, often within a matter of days.

The program is coordinated by Oksana Fisher, C.P.A., assistant professor of Business Administration.

Appointments are available, in Arnold, on Wednesdays and Saturdays from Feb. 3 to April 3.

For information call our VITA office at 410-777-2051 or e-mail vita@aacc.edu.

Internal Revenue Service (IRS)

VITA is free, but you still must prepare for your appointment.

Before meeting with the tax preparer at AACC for your scheduled appointment, review the following information and find out what important documents and forms you need to bring with you.

If you have a complex return, you are encouraged to see a professional preparer for assistance.

Bring these items to your appointment with the tax preparer.

Required Documents

Other Documents Needed (if applicable)